Financial Sentiment and Key Concerns

The report highlights a striking trend: 84% are actively pursuing additional income streams beyond their primary jobs. This surge reflects a nationwide push for financial resilience amid rising expenses. While 29% of consumers report improvements in their financial positions since January 2024—up from 24% — a substantial 35% of feel their financial position has worsened, although this is an improvement from 48% earlier in the year.However, economic uncertainty remains, as 36% of consumers express growing concerns over rising utilities bills, up from 32% last year.

Strategic Spending and Digital Transformation

Despite rising costs, 43% of Thai consumers believe their household's financial security remains unaffected. However, this group has become more cautious with their spending habits, a consistent trend since the beginning of the year.

To navigate the cost pressures, 45% of Thai consumers are opting for online shopping to access better deals, minimize trips, and maximize savings on fuel. This shift underscores the rising importance of convenience and affordability in consumer decision-making.

With household budgets under strain, 25% of Thai consumers are transitioning to purchasing larger, bulk-pack items to benefit from lower cost-per-usage. Additionally, 80% express a strong preference for products that are designed to be as affordable as possible, indicating an opportunity for businesses to innovate with cost-effective solutions.

Health and Home - Centric Lifestyles

The report also shows a notable shift toward long-term value, with 76% of consumers willing to pay a premium for products that are more durable, minimizing the need for frequent replacements. Consumers are also prioritizing home-based experiences over external entertainment, highlighting a preference for at-home leisure activities as a way to reduce overall costs.

Health-conscious spending is on the rise, with 74% of Thai consumers increasing their intake of vitamins and supplements to support overall well-being. This trend reflects a broader commitment to maintaining health amid rising healthcare costs and increasing awareness of wellness benefits.

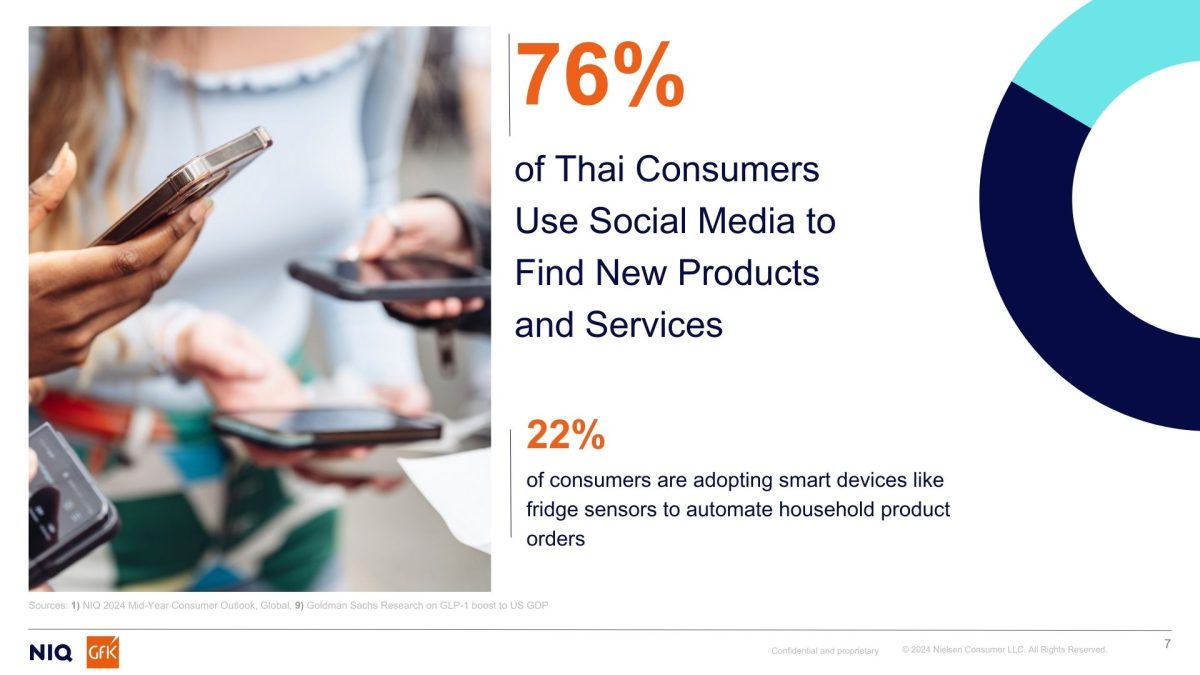

Digital Influence and Smart Consumption

The influence of social media continues to grow, with 76% of Thai consumers using these platforms to discover new products and services—significantly higher than the global average of 46%. Additionally, 22% of consumers are adopting smart devices like fridge sensors to automate household product orders, reflecting a growing trend towards convenience-driven consumption.

Looking Ahead: Trends to Watch

Social commerce, omni-channel experiences, AI integration, and fluctuating commodity prices are poised to influence consumer behavior in 2025. Notably, 1 in 3 Thai consumers are expected to increase their social media shopping activity, driving further shifts in retail trends.

For businesses looking to succeed in this evolving market, maximizing consumer penetration and offering value in multiple ways are essential strategies. With consumer recovery progressing slowly, products that deliver both affordability and innovation will likely capture long-term loyalty.

Download the full Mid-Year Consumer Outlook report for free at http://h.nniq.co/XV0x50TtXeg.

Source: Spotlight Asia