Dataxet Limited, a media intelligence service provider, has published the Thailand Media Landscape 2024-2025 report, highlighting key changes in the media industry through in-depth perspectives from experts across academia, social media, mass media, business, podcasts, and the influencer community.

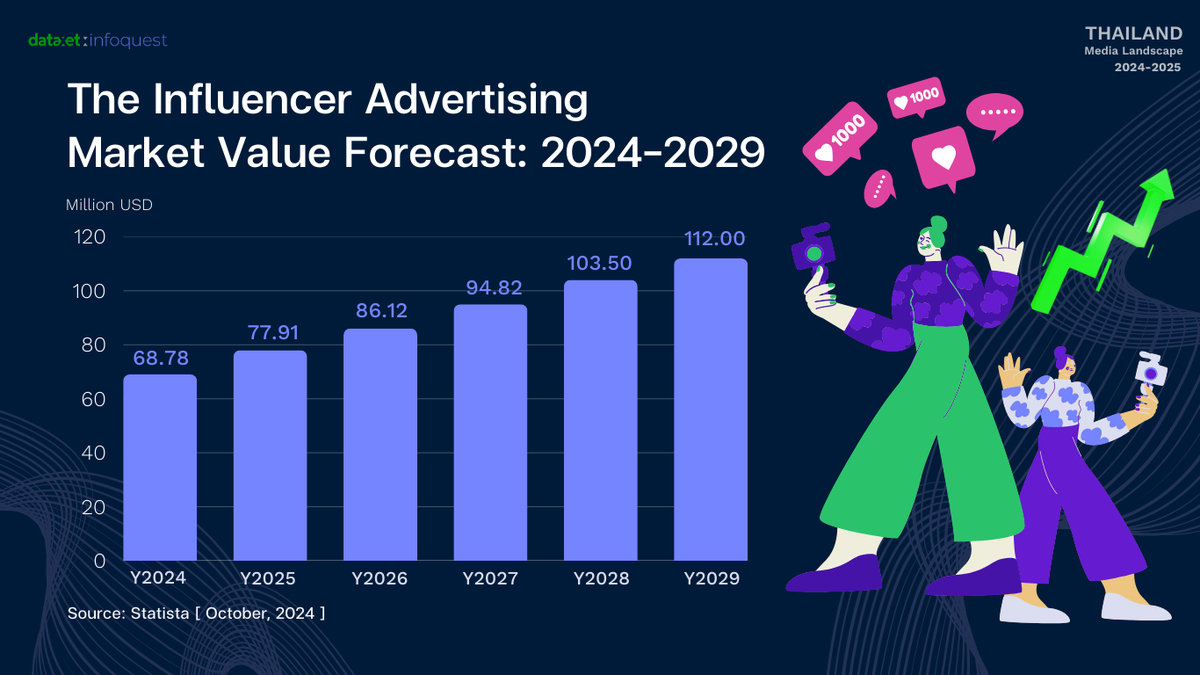

The rising popularity of niche content has enabled influencers and content creators to successfully expand their online presence into offline activities. This success stems from their dedicated follower base which, despite being niche-focused, is sizable and maintains strong engagement with influencers. Popular niche content categories encompass topics related to pets, family, history, finance, personal development, and news.

Notably, news content creators have emerged as a significant challenge for professional media outlets, commanding comparable followership. However, questions surrounding ethics and fact-checking practices remain important considerations for these influencers and creators.

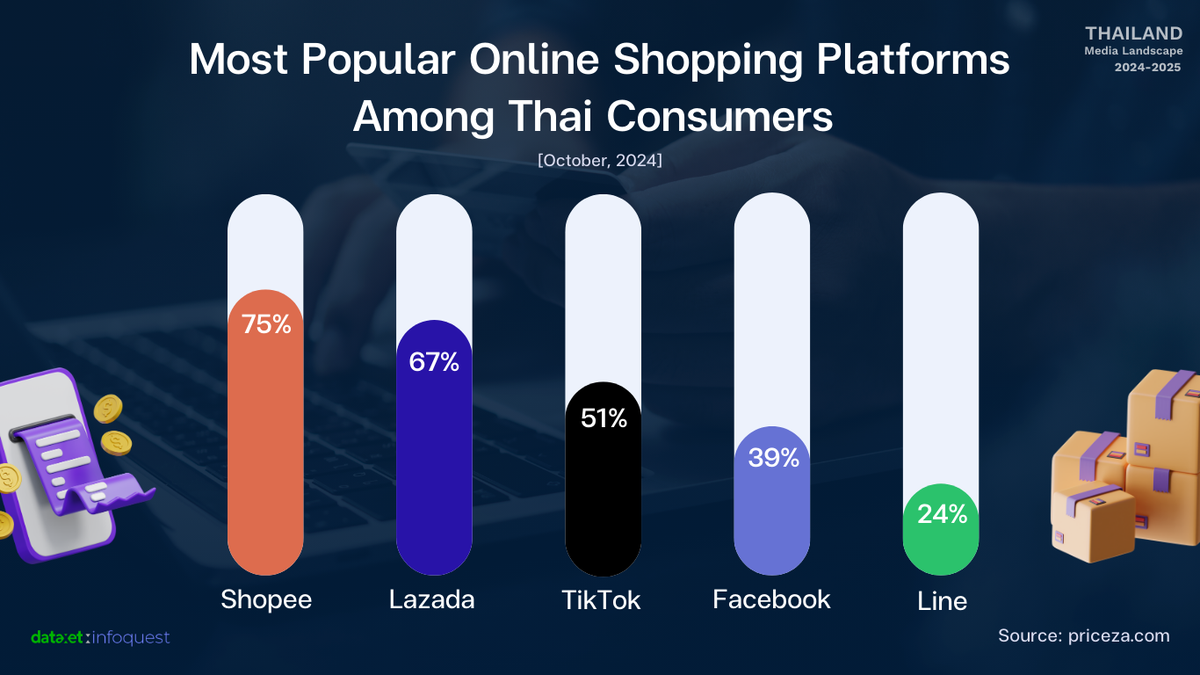

In terms of social media platforms, Facebook continues to be Thailand's number one choice, offering versatile features from content sharing to shopping. As e-commerce becomes increasingly important, social media has evolved into a growing revenue source, with TikTok leading this transformation by fully embracing e-commerce.

TikTok combines the advantage of hosting popular content while serving as a marketplace for online shopping, particularly appealing to Thai consumers' shopping preferences. According to Priceza.com statistics, TikTok has secured its position as Thailand's third-largest e-commerce platform, with 71% of users making immediate purchases while watching content.

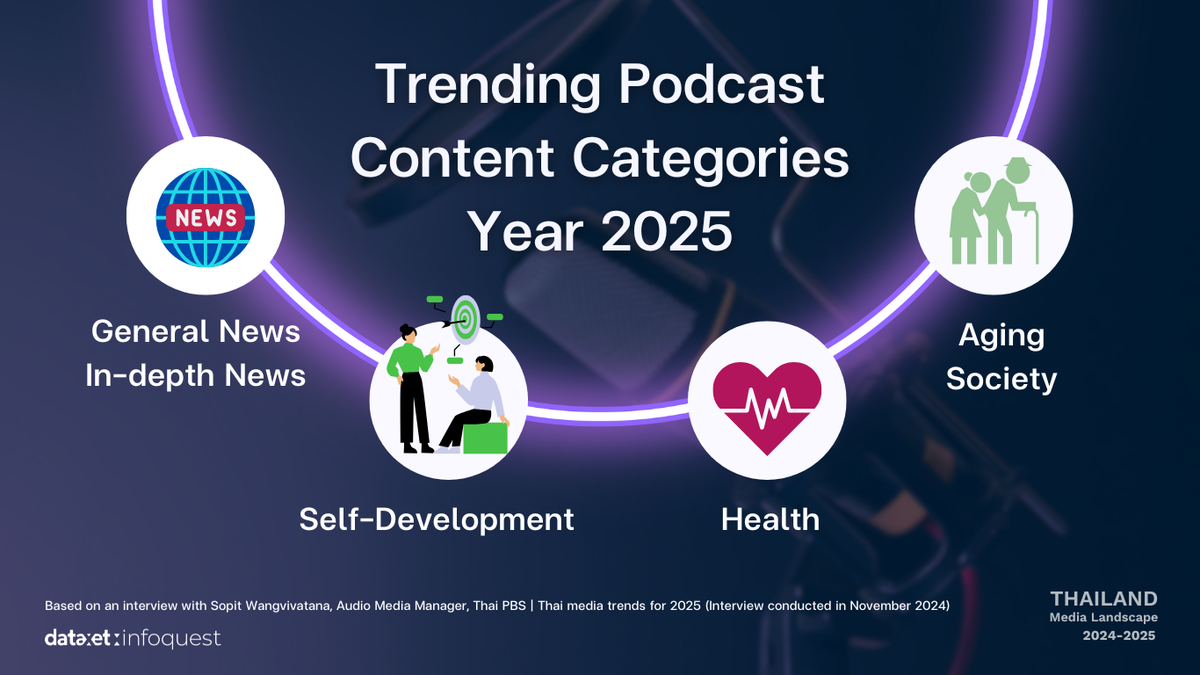

Podcasts and video podcasts have emerged as noteworthy players in the media landscape. Spotify's data from August 2024 reveals that podcast production in Thailand has grown remarkably by 81% over the past five years. This substantial growth reflects strong interest from both content producers and listeners, as it represents a low-cost medium that's easy and quick to produce, while aligning well with modern consumers' multitasking behavior.

Conversely, broadcaster remains a medium to watch closely, as it faces mounting challenges from the aforementioned media formats. Streaming viewership has increased to 54%, surpassing traditional TV viewing which dropped to 46% between 2023 and 2024. TV advertising revenue from January-July 2024 reached 33,875 million baht, maintaining the highest share at 50.13% of total media advertising budget, though showing a 2% contraction.

In the realm of artificial intelligence (AI), a Vero survey indicates that 95% of Thai journalists maintain a positive attitude toward AI use in media. News agencies and television stations have implemented AI in various forms, including AI news anchors and text-to-speech systems.

Looking ahead, 2025 will be another crucial year where traditional media must accelerate adaptation to face intensifying competition, while those who can create content addressing specific consumer needs will find significant growth opportunities.

Read 2025 Thai Media Outlook at https://www.dataxet.co/media-landscape/2025-en

For 2025 Thai Media Trends, visit https://www.dataxet.co/media-landscape/2025-en/thai-media-trends

Source: DATAXET