Thailand's Digital Habitat: The Top 10 as Daily Utilities

Thailand's top 10 tech brands share a common characteristic: they've transcended being mere "apps", "services," or "devices" to become the invisible infrastructure of modern Thai life. These brands have successfully positioned themselves not as nice-to-have but as "Habit Platforms", with their dominance reflecting specific cultural and behavioral patterns unique to the Thai market.

The Architecture of Digital Dependency

What makes these platforms indispensable becomes clearer when examining their specialized roles in the Thai digital experience:

YouTube (#1) functions as Thailand's premier entertainment destination, reaching 47.6 million users—or 72.8% of the country's internet user base, according to DataReportal. On a global scale, Thailand ranks 16th in usage (Source: Statista).

TikTok (#2) has evolved into a dual-purpose platform for entertainment, discovery, and social selling, boasting 56.6 million ad-reachable accounts in Thailand (Source: Nation Thailand).

Facebook (#3) serves as Thailand's default digital public square. Data from Popticles shows that 90.7% of the country's internet users maintain a presence on the platform, while Statista ranks Thailand 11th globally in usage.

LINE (#4) operates as Thailand's digital central nervous system, with 56 million monthly active users (Source: DataReportal). The platform is ranked second globally in usage according to World Population Review, integral for messaging, payments, and food delivery.

Google (#5) remains the primary gateway to information, dominating search with over 95% market share in Thailand (Source: CloudTech), despite the rise of alternative discovery methods.

Platform Dynamics: The Battle for Time and AttentionVideo Dominance in a Mobile-First Nation

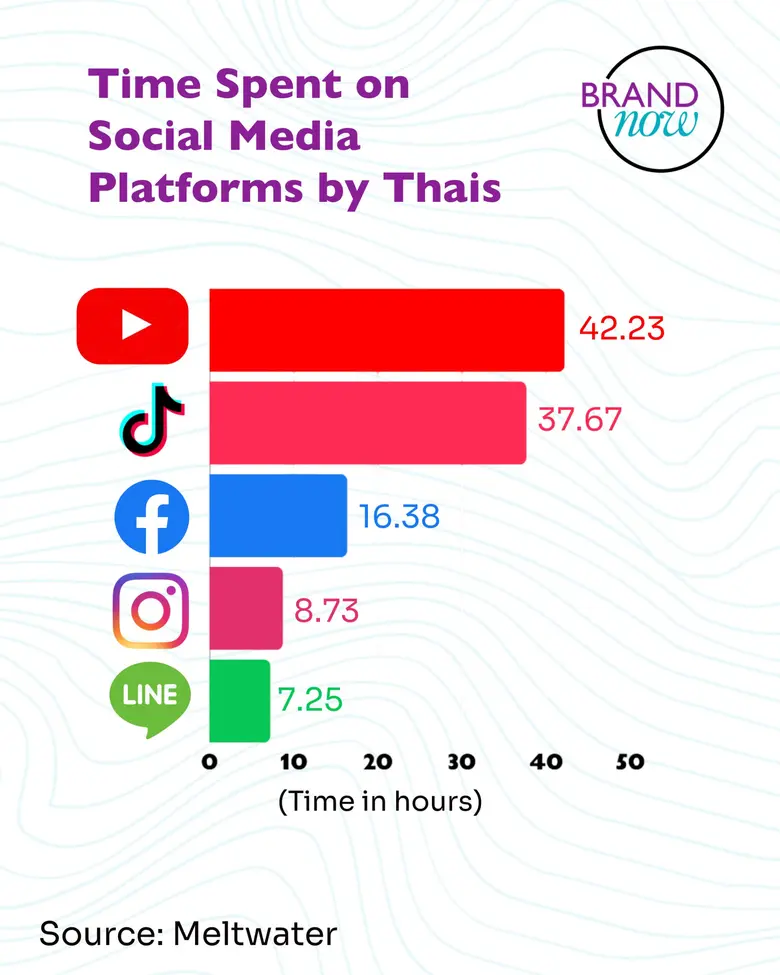

The supremacy of video platforms in Thailand is no accident—it reflects fundamental shifts in how Thais consume content and connect with each other. With 98% of Thai internet users accessing the net through mobile devices and dedicating 63.3% of their total internet time to smartphones, according to Meltwater, the conditions are perfect for video-centric platforms to thrive.

The fact that YouTube (#1) and TikTok (#2) sit at the very top of the food chain, above even Facebook and Line, both in the brand ranking and in the battle for time spent, shows an insight into the Thai consumer psyche: Video is the primary language of the nation. While TikTok is often painted as the challenger, the data suggests a bifurcation of utility rather than a direct replacement.

With a score of 60.5, YouTube remains the undefeated champion of long-form attention. According to DataReportal's 2025 Digital insights, Thai users maintain a "lean-back" habit, utilizing it as "Digital Television" for education, music, and prime-time entertainment.

Ranking second with 56.1, TikTok has become the "Dopamine Engine." YouGov data reveals that while usage is high across the board, 53% of Thai Gen Z spend more than 2 hours per day on the platform, compared to just 16% of Boomers.

The Hardware Divide: iPhone (#7) vs. Samsung (#9)

The hardware battle in the top 10 is a fascinating study in brand psychology.

iPhone: Ranking higher than its rival, Apple represents the "Aspirational Badge." In Thailand, the iPhone is a signifier of social standing and creative capability. Recent market data from GS StatCounter suggests Apple holds a strong lead in vendor market share (~32%) over Samsung (~20%), reinforcing its status as a "Social Currency."

Samsung: Samsung's presence in the top 10 represents "Functional Innovation." It appeals to the pragmatic tech enthusiast.

The Insight: While Samsung often leads in volume, in Thailand, the emotional connection to the Apple ecosystem pushes the iPhone two spots higher, as well as to the first place in smartphone market share (Source: GS StatCounter).

The Ascent of Niche and Emergent PlatformsUnderstanding the Growth Champions

While the top 10 represents established giants, the most dramatic movements in the rankings come from platforms that have identified and exploited specific gaps in Thailand's digital ecosystem. These growth champions demonstrate that even in a crowded market, opportunities remain for platforms offering distinctive value propositions.

Why did Lemon8 explode onto the scene with a staggering +24.4 growth score? Thai consumers are experiencing influencer fatigue on TikTok and Instagram. Lemon8 has positioned itself as the antidote to paid sponsorship, according to Amra & Elma, a lifestyle bible that feels like Pinterest meets Instagram, but with a focus on detailed, useful reviews. It fills the gap for searchable authenticity.

Pinterest's sudden surge (+16.1) correlates with the post-pandemic desire for "Life Design." As noted by Reliance Consulting, with travel, home renovation, and weddings back in full swing, many Thais are turning to Pinterest not for social connection but for Introverted Inspiration (Source: Meltwater). It is the only platform on the list that is about yourself, not your image.

While Netflix Thailand (+3.7) sees steady incumbent growth, HBO GO's massive jump (+9.7) is driven by event television. The consolidation of discovery content and the release of blockbuster IP like House of the Dragon have driven high-intent signups. Market analysis by PwC indicates that OTT video services are the fastest-growing media sector in Thailand, projected to grow 21% in 2025.

Threads' growth is a direct result of the volatility of X (formerly Twitter) (Source: The Social Shepherd). As X became more chaotic, Threads emerged as a safer alternative for a text-based community. Its integration with Instagram, allowing users to connect instantly, removed the friction of starting over, allowing it to capitalize on Instagram's massive user base.

Overall, the data shows a clear shift toward platforms that offer authenticity, intentionality, and emotional safety. As Thai users grow weary of traditional influencer culture and volatility in social spaces, they gravitate toward channels that feel more personal, useful, and stable.Strategic Implications and ConclusionNavigating the Platform Ecosystem

For marketers and business leaders, Thailand's brand rankings offer several strategic insights for connecting with Thai consumers:

Embrace Platform Diversity: The distribution of users across 7.1 platforms monthly, according to DataReportal, means effective reach requires a multi-platform strategy tailored to each channel's unique strengths and user expectations.

Prioritize Mobile-First Experiences: With 98% of Thai internet users accessing digital content via smartphone and spending over 5 hours daily on mobile internet (Source: DataReportal), mobile optimization is no longer optional.

The Future of Thailand's Digital Landscape

Thailand's tech brand ranking reveals a market, still dominated by global giants, but with space for specialized players who understand the unique contours of Thai digital behavior. As connectivity deepens and smartphone penetration approaches saturation, the next phase of competition will likely focus less on user acquisition and more on engagement depth and ecosystem integration.

About Brand Now

Brandnow.asia is an agency and consultancy serving startup, unicorns, disruptors, and blue-chip brands here in Thailand and Regional. We are part of the PRN network with partners that spans the globe. The focus is on strategy and brand communication with services ranging from public relations, marketing, internal communications, and direct marketing to event management. Some of our B2B clients are Grohe, Merck, Tealium and Electrolux. Our B2C clients include Grab, Lalamove, adidas, Ksher,and Wechat Pay.

For media inquiries, please contact:

Kittisak Yingyai Tel: +6691 797 8277

Email: [email protected]

Brand Now Co., Ltd Tel. 02 105 4217

Email: [email protected]