Thailand's cement industry remains a fundamental pillar of the country's construction and industrial ecosystem, underpinning both domestic development and regional infrastructure supply chains. Contributing approximately 7-8% of GDP, the sector plays a critical role in supporting public infrastructure, private construction, and downstream building-material industries. However, despite its strategic importance, the industry is currently navigating a prolonged period of structural adjustment, shaped by subdued demand, persistent oversupply, and a rapidly evolving regulatory and sustainability landscape.

Thailand's macroeconomic environment provides essential context for understanding current cement market dynamics. Following a modest rebound in 2024—when GDP growth reached approximately 3.2% supported by tourism recovery, public investment, and export improvements—economic momentum is expected to moderate in 2025. Growth forecasts have been revised downward to the 2.0-2.8% range amid political uncertainty, delayed fiscal disbursement, and weakening private investment sentiment. While government stimulus measures and infrastructure spending continue to provide support, uncertainty around budget execution and policy continuity has weighed on overall construction activity.

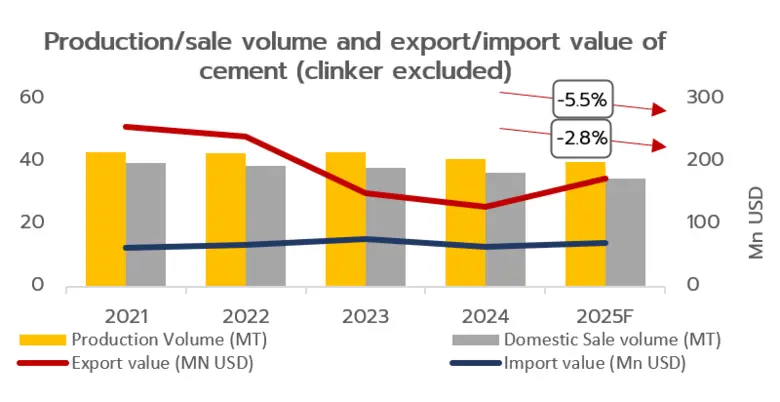

These macroeconomic conditions have translated directly into weaker cement demand. Domestic cement consumption is projected to contract by around 5.5% year-on-year in 2025, falling to approximately 34.7 million tons. The decline is driven primarily by weakness in private-sector construction, particularly residential housing. High household debt levels, persistent housing oversupply, and declining construction permits have constrained new project launches and dampened demand for bagged cement. While some recovery was observed in early 2025, the underlying fundamentals suggest that private housing demand will remain under pressure in the near term.

Public-sector construction continues to act as a stabilizing force for cement demand, though its impact has been more limited than in previous cycles. Large-scale infrastructure projects—including railways, ports, airports, and logistics facilities—remain key demand anchors, particularly under the Eastern Economic Corridor (EEC) framework. However, the pace of project rollout has slowed, and delays in budget approval and tendering processes have constrained near-term uplift. As a result, public investment has provided baseline support rather than acting as a strong growth driver for the cement industry.

On the supply side, Thailand's cement industry remains characterized by significant excess capacity. Installed production capacity is estimated at around 75 million tons per year, while output in 2025 is forecast at approximately 40.1 million tons, representing a year-on-year decline of 2.8%. Capacity utilization is expected to fall to roughly 53%, underscoring the chronic oversupply that continues to define the market. This imbalance between supply and demand has exerted sustained pressure on prices, margins, and capital efficiency across the sector.

Exports have historically served as a release valve for Thailand's surplus cement capacity, but their role has diminished structurally in recent years. Export volumes are estimated at around 6 million tons in 2025, down sharply from approximately 12 million tons in 2021. Increased competition from Vietnam and China, coupled with weaker demand in key destination markets such as CLMV countries, South Asia, and parts of the Middle East, has eroded Thailand's export competitiveness. As a result, the industry has become increasingly reliant on domestic demand, heightening its exposure to local construction cycles.

Pricing trends reflect this challenging supply-demand balance. Average Portland cement prices have declined from their 2022 peak, easing to approximately THB 1,809 per ton in 2025 following a normalization of global energy prices. While lower coal and electricity costs have provided some cost relief, margin recovery remains constrained by elevated logistics expenses, labor costs, and the growing burden of environmental compliance. The gradual introduction of carbon-related costs further limits pricing flexibility, particularly in a market where demand remains fragile.

Structurally, Thailand's cement industry is highly concentrated and oligopolistic. The top three producers—Siam Cement Group (SCG), Siam City Cement (SCCC), and TPI Polene (TPIPL)—collectively control nearly 90% of national production capacity. This concentration has resulted in relatively stable market shares and high barriers to entry, discouraging new capacity additions despite prolonged oversupply. Recent corporate activity has therefore focused less on expansion and more on consolidation, downstream integration, energy optimization, and value-added building-material adjacencies rather than large-scale greenfield investments.

A defining feature of the industry's current transformation is the accelerating shift toward sustainability and decarbonization. Cement production is widely recognized as a hard-to-abate sector, accounting for a significant share of industrial carbon emissions due to the clinker production process. Thailand's national commitments to carbon neutrality by 2050 and net-zero emissions by 2065 have placed increasing pressure on cement producers to adapt their production processes, product portfolios, and energy strategies.

In response, leading producers are investing heavily in low-carbon and hydraulic cement, clinker substitution technologies such as limestone calcined clay cement (LC?), and alternative fuels including refuse-derived fuel (RDF), biomass, and waste-to-energy solutions. Participation in voluntary carbon markets and preparation for a future emissions trading system further signal a structural shift in industry economics, where environmental performance is becoming a key competitive differentiator rather than a regulatory afterthought.

Looking ahead, the outlook for Thailand's cement industry remains mixed in the near term but structurally constructive over the long term. Short-term headwinds—including weak private construction, fiscal uncertainty, structural oversupply, and rising compliance costs—are likely to continue constraining demand and profitability through 2025-2026. However, longer-term fundamentals such as urbanization, infrastructure modernization, regional connectivity, and the global transition toward green construction provide a pathway for gradual recovery.

Ultimately, the industry's future growth will depend less on volume expansion and more on strategic repositioning. Producers that successfully enhance operational efficiency, scale low-carbon products, align with green procurement frameworks, and adapt to evolving carbon-pricing mechanisms will be best positioned to capture emerging opportunities. With the right policy clarity and sustained investment momentum, Thailand has the potential to reinforce its role as a regional leader in sustainable cement manufacturing and low-carbon building materials over the medium to long term.